#Types of Immovable Property

Explore tagged Tumblr posts

Text

Movable vs. Immovable Property: A Complete Guide to Smart Asset Management

Introduction

In the world of assets and investments, understanding the distinction between movable and immovable property is essential. Whether you're a real estate investor, business owner, or financial planner, knowing the legal, financial, and commercial implications of different types of property can significantly impact your asset management strategy. In this comprehensive guide, we delve into the meaning, classification, and examples of movable and immovable property to help you make informed decisions.

What is Movable and Immovable Property?

Movable Property:

Movable property consists of assets that can be easily transferred from one place to another without losing their value or function. These items are not permanently attached to the earth and typically require minimal legal procedures for transfer or sale.

Immovable Property:

Immovable property refers to assets that are permanently fixed to the land, such as real estate, infrastructure, and natural resources. These assets require legal documentation, registration, and regulatory compliance for transfer or sale.

Classification of Movable and Immovable Property

Categories of Movable Property

Movable property is divided into two major categories:

Tangible Movable Property:

Automobiles (Cars, Motorcycles, Trucks)

Home Appliances and Electronics

Furniture and Decor

Jewelry and Precious Metals

Livestock and Agricultural Equipment

Intangible Movable Property:

Stocks and Shares

Bonds and Mutual Funds

Intellectual Property (Patents, Trademarks, Copyrights)

Digital Assets (Cryptocurrency, NFTs, Domain Names)

Categories of Immovable Property

Immovable property is broadly classified as:

Land and Real Estate:

Residential Properties (Houses, Apartments, Villas)

Commercial Properties (Offices, Malls, Factories)

Agricultural Land

Forests, Mines, and Natural Reserves

Permanent Structures and Developments:

Roads, Bridges, and Highways

Dams and Water Bodies

Fountains and Wells

Underground Utility Networks (Pipelines, Sewage Systems)

Examples of Movable and Immovable Property

Movable Property in Action:

A company purchasing new office furniture and IT equipment.

An investor trading stocks and cryptocurrency for short-term gains.

A vehicle owner selling their car through an online marketplace.

Immovable Property in Action:

A real estate developer acquiring land for a new residential project.

A business owner investing in commercial office spaces.

A family purchasing an apartment for long-term security and stability.

Legal and Financial Implications

Ownership and Transfer Regulations:

Movable property can be transferred through a simple sale agreement or invoice.

Immovable property transactions require registration, deed agreements, and adherence to local property laws.

Taxation and Duties:

Movable assets such as vehicles attract road tax, GST, and VAT.

Immovable property is subject to real estate tax, stamp duty, and capital gains tax upon sale.

Investment Potential:

Movable property like stocks, gold, and digital assets offers flexibility and high liquidity.

Immovable property provides long-term capital appreciation, security, and passive income opportunities.

Conclusion

Understanding the difference between movable and immovable property is critical for smart asset management, wealth creation, and legal compliance. Movable property offers convenience and liquidity, while immovable property ensures stability and long-term financial growth. By classifying and managing your assets effectively, you can optimize investments and protect your wealth for the future.

For expert insights on property transactions, legal procedures, and investment strategies, consult professional real estate advisors and financial experts today!

visit now:90485 90485

#Movable Property#Immovable Property#Property Classification#Property Law#Real Estate Law#Personal Property Law#Legal Definitions#Asset Classification#Meaning/Definitions:#Definition of Movable Property#Definition of Immovable Property#Meaning of Chattels#Meaning of Fixtures#Legal Meaning of Property#Classification:#Types of Movable Property#Types of Immovable Property#Classification of Assets#Tangible vs. Intangible Property#Real vs. Personal Property

0 notes

Text

Tamlin Week Day 5

I know this isn't exactly the type of content you would expect from me for the prompt shapeshifter of @tamlinweek, but as soon as I saw this coloring page by @thrumugnyr I couldn't resist the urge to open Paint and give myself a hour break to colour it like I used to do back when computers were not that accessible and made the sounds of an aerospace engine. I know it's not perfect, and that there will be at least a million people far more talented than me who will make this wonderful drawing into a true masterpiece, but you can't understand how grateful I am for the childlike joy you gave me, so I thought I'd share the result along with a short scene it inspired

Plot: War is only a distant memory, the Spring Court has returned to its former glory, and Tamlin is finally coming back to understand what it means to be loved.

Pairing: Tamlin x Elain x Lucien if you want to see it that way, just Elucien if you're not into throuples. Obviously, it's Tamlin centric.

Words: 444

Tamlin was dozing in the shade of a wisteria-covered gazebo, his large paws resting under his snout like a pillow, when he heard a disturbance in the silence of a lazy, clear afternoon. Elain must’ve noticed it too, her legs tensing a little on his side, but her delicate hands kept stroking the golden fur on his spine, the area she was preparing to be adorned with little, bright pink daphne flowers. It was one of her favourite pastimes, when he was in his beast form, to cover him in colourful arrangements.

“To make you less scary,” she had said when he confronted her after the second or third time it happened. “More approachable for the children.”

Tamlin was nearly sure it was an innocent lie to safe face, but he didn't mind the attention, or all those younglings hanging on his property, looking for advice about horse-riding, gardening, and love matters, therefore he had no intention of pressing the matter to obtain a more exhaustive answer. He didn't want to frighten her, or see her return to her sisters after the less than amicable departure from the Night Court that gave him a pretext to rebuild his friendship with Lucien. Against all odds, his best friend’s mate, the sister of the one who had broken his heart and robbed him of his subjects’ trust, had been a pleasant addition at the Manor; where Feyre was stubborn and immovable, Elain was affable and ready for constructive confrontations, and on those same occasions in which the youngest Archeron would’ve withdrawn into herself and put on a defensive attitude, the middle one had been able to remain objective and even help him.

“Have you really been lounging around here all this time?” Lucien asked, cheerfully, once he was within their field of vision. Tamlin sat up lazily, showing a hint of fangs at the emissary, a tacit warning not to interrupt the sacredness of their bonding.

“What do you think, did I exaggerate on the antlers?” Elain asked, nodding toward the intricate ivy wreath she had wrapped around the entire lenght.

“I think they’re gorgeous,” he replied, finally allowed to be soft and careless, before giving her a light kiss on the temple and dropping behind her, the back Tamlin had once been forced to whip resting on his side.

“Don’t stop on my account,” he added as he made himself comfortable, sinking down until his head was on the beast’s belly, like they used to sit in the meadow when he first came from Autumn, when Elain turned to shot him a questioning look. “I just wanted to spend some time with my favourite people.”

#tamlinweek2024#tamlain#tamcien#tamlin x elain x lucien#i want them to live a soft life#they all deserve to heal and be peaceful

19 notes

·

View notes

Text

Tax Implications for Real Estate Buyers and Sellers in Panama

Panama's tax code is subject to periodic changes; therefore, any person contemplating a tax burden resulting from real estate purchases ought to seek the advice of a qualified professional who knows about tributary matters.

The following is a general overview regarding taxes related to the most common sale and purchase types of real estate transactions. It is not to be considered as complete or as advice.

1. Property Taxes

Any location or any type of REAL ESTATE IN PANAMA, whether urban or rural, is eligible to pay property taxes. If the following conditions are met according to Article 764 of the Panamanian Tax Code then one can get some exemptions from property tax, these conditions include:

All properties registered at a value of $30,000 or less, including improvements of land, for example, construction.

Land devoted only to agricultural operations such as agriculture and registered with the Ministry of Agriculture and Development at no more than $150,000.

The real estate tax basis should be understood as a fusion between the value of the land and the improvements of the property; it is any construction on the land, appraised by the Land Commission, which is known by the name Oficina de Catastro. A real estate transaction at a price higher than the appraisal value can then be recorded with the new, higher value, making it the new basis for taxation.

Property taxes exemption

One can enjoy an exemption of property taxes for 20 years in Panama properties for which the occupation permits were issued before 2011 December. However, property tax exoneration in Panama has changed today.

Registration value determines the number of years a property enjoys free from taxes today.

Any property will automatically grant 20 years of exoneration if registered under $120,000 in value. For properties whose values amount to a range between $120,000 and $300,000, exoneration for 10 years is granted. For improvements if the values are over $300,000, 5 years of exoneration can be applied.

The thing of prime interest is that, although the real estate itself benefits from the exemption in terms of paying tax, the piece of land where it sits doesn't unless it is worth under $30,000 on record. In whichever case the immovable property of the property, the tax about land should be paid at the initial days. It is divided proportionately among all of the individuals on the premises within that area of land and tends to range within $500 yearly.

In the case of acquiring a Panama property whose registered value qualifies it for property tax exemption, the difference between the sale price and original registered value will determine the property tax amount to be paid. For instance, in the event of a resale property being sold at $400,000, while the original registered value of the same property stood at $240,000. The seller is responsible for the payment of the property taxes over the period for which the seller has owned the property calculated over the difference amount of $160,000 so that he may transfer the property and get it registered as sold.

seller can be exempted from paying tax imposed on the new price paid provided that such exemption falls within the timeframe for the exoneration. It typically takes around 6 months and some legal costs. We suggest you employ a competent accountant or attorney specializing in this type of transaction.

2. Income Tax from Rentals

Those having a rental income are exempted from national and municipal taxes, administrative costs, maintenance and repairs, and depreciation of the property.

3. Value Added Tax

Value-added tax is a sales tax that applies to the imported goods, products sold, or services rendered in Panama. The individual receiving rental income in Panama is taxed under this, at a flat rate of 7% of the gross rent. If the monthly revenue is less than $3,000 and the average annual revenue is below $36,000, the tax will be exempted in the last tax year.

4. Real Property Transfer Tax

When selling or transferring a property, the Real Property Transfer Tax is imposed and computed on the higher of the aggregate value, be it the sale price or the registered value, together with the improvements. The tax rate is 2% of the higher value out of the two, and an additional 5% for every year that the property has been owned.

5. Capital Gains Tax

Capital gains tax is a flat rate of 10% computed on the net gain realized from the sale of the property.

Know the time to pay your Panama real estate taxes.

Panama's real estate tax season happens 3 times annually, at the end of April, August, and December.

How to check the amount of real estate taxes due

You can apply online from a DGI tax authority or revenue agency for your unique Taxpayer ID if you don't have one already. An NIT is a number that is assigned uniquely to taxpayers and this number allows them to view their taxation information in an online platform which is offered by the tax authority website. No service charges are needed to acquire a NIT or to use the online system. You can also print certificates of good standing for property taxes that are being paid.

2 notes

·

View notes

Text

Understanding Real Estate: A Comprehensive Guide in 2025

Real estate is a term that encompasses the buying, selling, and management of land, buildings, and properties. It is one of the most significant sectors in any economy, contributing to both individual wealth creation and broader economic development. In this blog, we’ll dive into its various types, and its role in our lives.

What is Real Estate?

Real estate refers to properties consisting of land and the buildings on it, along with its natural resources like water, crops, and minerals. It also includes immovable property of this nature and an interest vested in it, whether as an ownership or leasehold.

Types of Real Estate

It can be broadly classified into four categories:

Residential: This includes properties such as single-family homes, apartments, condominiums, townhouses, and vacation homes. These are primarily used for living purposes.

Commercial: This type involves properties used for business activities. Examples include office buildings, shopping malls, hotels, and warehouses.

Industrial: These are properties specifically designed for manufacturing, production, storage, and distribution. Factories and logistics hubs fall under this category.

Land: This includes vacant land, farms, ranches, and other undeveloped or raw land properties.

Why Real Estate Is Important?

It serves as a cornerstone of the economy and individual financial growth. Here’s why:

Wealth Building: Owning property is one of the most effective ways to build long-term wealth. It often appreciates in value, providing returns to investors and owners.

Economic Growth: This sector generates significant employment and contributes to the GDP of a country.

Essential Infrastructure: It provides homes, businesses, and industries with the space they need to operate.

How to Get Started in Real Estate

If you’re looking to invest in or work with this industry, here are some tips to get started:

Research the Market: Understand the local Property market, property values, and trends.

Set Clear Goals: Decide whether you’re investing for rental income, flipping properties, or long-term appreciation.

Seek Professional Guidance: Work with Property agents, brokers, and financial advisors to make informed decisions.

Understand the Risks: Like any investment, It has risks, such as market fluctuations and maintenance costs.

The Future of Real Estate

This industry is evolving rapidly with advancements in technology and changing consumer preferences. From virtual property tours to smart home technology, the future of real estate promises increased convenience and efficiency.

Additionally, sustainability is becoming a major focus. Green buildings and eco-friendly construction practices are gaining popularity, reflecting the shift towards more environmentally conscious choices.

Tips for Buyers, Sellers, and Investors

Navigating the real estate market can be daunting, but the right strategies can make all the difference. Here are some tailored tips:

For Buyers:

Do Your Homework: Research neighborhoods, schools, and local amenities to ensure the property fits your lifestyle.

Get Pre-Approved: Secure pre-approval for a mortgage to streamline the buying process and strengthen your negotiation position.

Think Long-Term: Consider the property’s potential for appreciation and its suitability for your future needs.

For Sellers:

Stage Your Home: Invest in staging to showcase your property in its best light. First impressions matter!

Set the Right Price: Work with an experienced agent to price your home competitively based on market trends and comparable properties.

Market Effectively: Leverage online platforms, professional photography, and social media to reach a broader audience.

For Investors:

Diversify Your Portfolio: Spread your investments across different property types and locations to mitigate risks.

Understand Market Cycles: Stay informed about market trends to time your investments effectively.

Focus on ROI: Evaluate potential properties based on their return on investment, considering factors like rental income and appreciation.

Final Thoughts

Real estate is more than just buying and selling properties; it’s about creating spaces that cater to the needs of individuals and businesses while contributing to economic stability. Whether you’re an investor, a homeowner, or someone exploring career opportunities in this field, understanding the fundamentals of Property is crucial for making informed decisions.

2 notes

·

View notes

Text

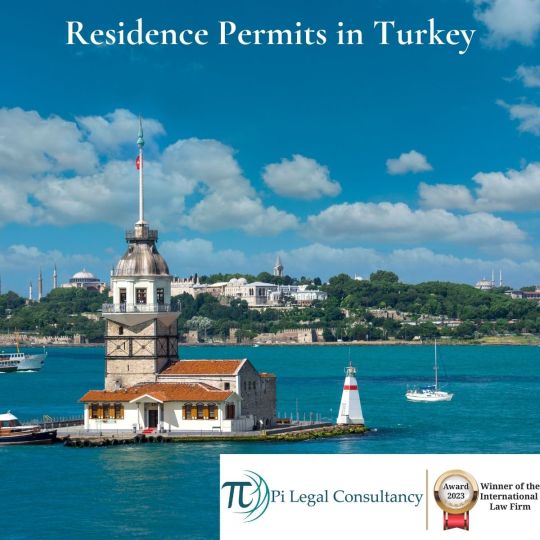

Residence Permits in Turkey

Introduction

Overall, this article mainly focuses on legal requirements, duration, refusal, non-renewal or cancellation of residence permits in Turkey. As a result, the acquisition of Turkish citizenship does not fall within the scope of this paper. It is notable that Turkish immigration lawyers are of great importance in giving a Turkish citizenship and|or residence consultancy to foreign visitors. Legal practitioners face several difficulties in the field of residence permits in Turkey.

Is Turkey going to stop issuing residence permits in Turkey?

What is the Meaning of a Residence Permit?

To clarify, “residence permit” refers to ‘an official document that allows you to live in a country that you were not born in’. The term “residence permit” does not imply permanent residence. For this reason, it contains a “temporary residence permit”, granted to a foreigner for a specified period of time. Thus, residence permits need to be renewed regularly.

What is the Difference Between a Work Permit and Residence Permit?

There is a growing consensus that work permit and residence permit have very different meanings. It is, however, striking that there is also a clear connection between those terms. Because of this relationship, a valid work permit as well as work permit exemption confirmation document issued pursuant shall be considered as a residence permit. It necessarily follows that holders of a residence or a work permit are granted to live within a specific period of time in Turkey.

What are the Main Principles of the Turkish Legal Framework on Residence Permit?

Significantly, the Law on Foreigners and International Protection Law (No:6458) is intended to provide ‘the principles and procedures with regard to foreigners’ entry into, stay in and exit from Turkey’. The said Law plays a central role in regulating main standards and types for residence permit.

How Can You Get a Residence Permit in Turkey?

In essence, Article 29 of the Law on Foreigners and International Protection Law (No:6458) regulates the following types of residence permits:

Short-term residence permit,

Family residence permit,

Student residence permit,

Long-term residence permit,

Humanitarian residence permit,

Victim of human trafficking residence permit.

Since this paper will entirely deal with short-term residence permits, other types of residence permit go beyond the present text. This work will specifically concentrate on short-term residence permits in Turkey, as stressed above.

Which types of short-term residence permits are possible in Turkey?

Pursuant to Article 31, short-term residence permit in Turkey may be given to the foreigner who:

Conducts scientific research,

Owns immovable property in Turkey,

Establishes business or commercial connections,

Participates in on-the-job training programmes,

Arrives to attend educational or similar programmes as part of student exchange programmes or agreements to which the Republic of Turkey is a party to,

Wishes to stay for tourism purposes,

Intends to receive medical treatment, provided that they do not have a disease posing a public health threat,

is required to stay in Turkey pursuant to a request or a decision of judicial or administrative authorities,

Transfers from a family residence permit,

Attends a Turkish language course,

Attends an education programme, research, internship or, a course by way of a public agency,

Applies within six months upon graduation from a higher education programme in Turkey,

Does not work in Turkey but will make an investment within the scope and amount that shall be determined by the Council of Ministers (foreign investors and his/her spouses, minor children or foreign dependent children,

is a citizen of the Turkish Republic of Northern Cyprus.

How Long is a Short-Term Residence Permit Valid in Turkey?

Generally speaking, short-term residence permits may be granted for a maximum of two years. Of course, there are also exceptions and following conditions. The duration in question is not the case for people who do not work but will make an investment in Turkey. Also for those who are citizens of the Turkish Republic of Northern Cyprus. Five year duration is given to them.

As for follow-up requirements, residence permits issued for people attending a language course shall only be issued twice.

Residence permits granted to those foreigners who apply within six months upon graduation from a higher education programme in Turkey shall only be issued once with a maximum one year duration.

What is a Long Term Residence Permit?

It is of course possible to obtain a long-term residence permit in accordance with Article 42. Indeed, if you have been residing in Turkey for at least eight years on a permit, you may be found eligible for a permanent residence permit by the relevant authorities. Relevant people should make an application to the Provincial Directorate of Migration Management (İl Göç İdaresi Müdürlüğü). Here is the document check list from the Presidency of the Republic of Turkey Investment Office.

What are the conditions for a short-term residence permit in Turkey?

What are the conditions for a short-term residence permit in Turkey? In summary, the involved foreigner is required to fulfill the following conditions regulated in Article 32 of the Law in question. These conditions are:

The submission of supporting documentation and information regarding the reason of stay in Turkey,

Not to fall within the scope of Article 7, designed for foreigners who shall be refused to enter into Turkey,

To live in accommodation conditions that conform to general health and safety standards,

Upon request, the presentation of criminal record certificate issued by the competent national authorities in his/her country of citizenship or legal residence,

The submission of information on their address of stay in Turkey.

What are the Reasons For Refusal, non-renewal or Cancellation of Short-Term Residence Permit in Turkey?

What are the Reasons For Refusal, non-renewal or Cancellation of Short-Term Residence Permit in Turkey? Under the following situations, a short-term residence permit shall not be granted, shall be canceled if has been issued, and shall not be renewed when,

One or more of the conditions provided for in Article 32 are not met or no longer apply;

It is established that the residence permit is used outside the purposes of those it is issued for;

There is a current removal decision or an entry ban to Turkey in respect to the foreigner,

Upon violation regarding the period which is lived outside of Turkey.

What are the New Rules for Residence Permits in Turkey For 2023?

Owing to a legislative change on Article 20 of the Regulation on the Implementation of the Law on Turkish Citizenship (No:5901), a new acquisition type of Turkish citizenship enters into force. When foreigners deposit at least USD 500.000 or equivalent foreign currency or Turkish lira in the private pension system with the condition of holding this fund for three years, as attested by Insurance and Private Pension Regulation and Supervision Agency, they may gain Turkish citizenship. Moreover, the minimum amount of investment for home purchase-based citizenship has been increased. The acquisition of Turkish citizenship requires a comprehensive legal guidance by Turkish citizenship lawyers.

Conclusion

Having regard to the aforementioned observations, even the types and legal requirements of short-term residence permit is not simple; albeit very confusing. To conclude, a foreigner should be aware of his/her desire, interest and personal necessities about residence permit. But that is not enough. Accordingly, in order to avoid any unexpected challenges, every single step should be taken carefully. Therefore, a foreigner also needs high-quality and on-the-ground advice by English speaking lawyers in Turkey for a right direction.

3 notes

·

View notes

Text

LAP Loan 2025: Get Instant Loan Against Property Online Without Income Proof

Starting Fresh: Turning Your Property Into Instant Funds in 2025

In today’s rapidly growing economy, many salaried and self-employed individuals are asset-rich but cash-strapped. Whether it’s funding your child’s education, handling medical emergencies, expanding your business, or managing wedding costs, the solution might be lying under your roof, literally. Welcome to the world of LAP Loans (Loan Against Property) — one of the fastest-growing funding solutions in India.

Let’s break it down step-by-step in simple language, solve your common doubts, and help you apply online without the stress of paperwork or hidden costs.

What is a LAP Loan?

LAP Loan stands for Loan Against Property, a secured loan where you mortgage your owned property — residential or commercial — to a bank or NBFC and receive a loan amount against it.

This means, instead of selling your house or land, you keep it as collateral and still retain ownership while raising funds.

LAP Full Form: Loan Against Property

Type: Secured Loan

Usage: Personal, business, education, wedding, debt consolidation, emergency

Ownership: Retained by the borrower

Approval Speed: Within 48–72 hours (online)

Who Can Apply for a LAP Loan in 2025?

Anyone who owns an immovable property — salaried or self-employed — can avail of a LAP loan. Here’s how it breaks down:

For Salaried Individuals:

Should be employed with a stable income

Have a clear property title

Minimum age: 21 years; Max: 60 years

Salaried LAP meaning: A property-backed loan provided to salaried people for personal or home-related expenses

For Self-Employed Individuals:

Must own a registered business or practice

Income proofs or ITRs might be required

Flexible repayment tenures up to 15 years

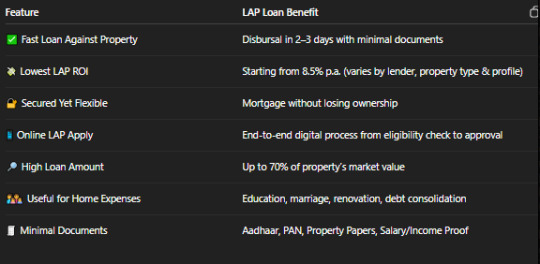

Why Choose LAP Loan in 2025?

Here's why LAP is trending among Indians this year:

LAP Loan Eligibility Criteria in India (Salaried & Self-Employed)

For Salaried Individuals:

Minimum ₹25,000 salary/month

At least 1-year job stability

Clear credit history (CIBIL score 650+ preferred)

Property should be in urban/semi-urban areas

Co-applicant allowed (spouse/parent)

For Self-Employed:

Minimum 2 years of business continuity

Income proof (ITRs or bank statements)

Office or house property can be mortgaged

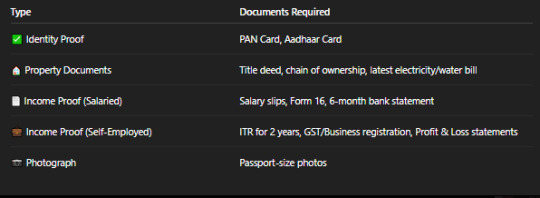

LAP Loan Documents Required

Make sure you have the following documents ready when you apply:

LAP Loan Process – Step-by-Step

Applying for a Loan Against Property in 2025 has become easier than ever:

Visit your lender’s website or a loan marketplace

Select “Apply for LAP Loan Online.”

Enter details – name, mobile, income, property info

Upload soft copies of the required documents

Await tele-verification and property inspection

Get approval within 24–72 hours

Receive funds directly into your account

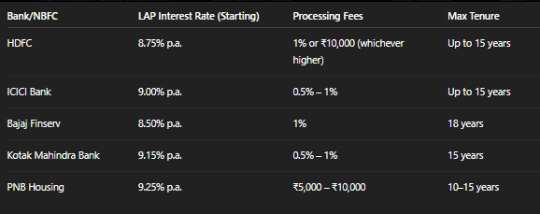

Tip: You can also compare LAP ROI (rate of interest) across banks like HDFC, ICICI, Bajaj Finserv, and Kotak to find the lowest one.

LAP ROI (Rate of Interest) Comparison 2025

Note: Rates vary by city, profile, and property type. Always check the latest offers.

Common Use Cases – Why People Take LAP Loans in India

Child’s higher education (domestic & abroad)

Marriage expenses

Renovating or building a home

Business working capital

Consolidating high-interest debts

Emergency medical needs

Who Can Avail a Loan Against Property in India?

Salaried employees (Govt/Private)

Doctors, lawyers, CA professionals

Business owners, shopkeepers

Retirees with property income

NRIs (in selected banks)

Even if you have a low salary or no ITR, private loan against property options exist, but ROI will be slightly higher.

FAQ – Frequently Asked Questions

Q1. What is a LAP loan, and how is it different from a personal loan?

Ans: LAP is a secured loan where you mortgage property, while a personal loan is unsecured. LAP offers higher amounts and lower interest rates.

Q2. Can I get a loan against property without income proof?

Yes, some NBFCs and private lenders offer LAP without a salary slip, based on property value and alternate income sources.

Q3. What kind of property can be used for LAP?

You can mortgage residential, commercial, or rented property (owned) — but it must have a clear legal title.

Q4. How fast can I get an immediate loan against property?

With pre-approved documents and an online application, you can get funds within 2–3 working days.

Q5. Are there fees and charges on the LAP loan for salaried individuals?

Yes. Banks may charge processing fees (0.5–1%), legal charges, valuation fees, foreclosure charges (if applicable), and GST.

Final Words: Should You Apply for a LAP Loan in 2025?

If you're looking for a fast, flexible, and low-interest loan, then a Loan Against Property (LAP) is one of the best options in 2025. Whether you are salaried or self-employed, you can apply for a LAP loan online and unlock the power of your own property, without selling it.

Before choosing a lender, compare LAP rates, check eligibility, and always read the fine print on charges.

Call to Action

Apply for LAP Loan Online Today – Get Fast Funds Against Property with Lowest ROI in 2025.

Want help comparing top LAP offers? Message us, and we’ll guide you 1-on-1!

#lap loan#lap loan against property#loan against property for salaried person#what is lap loan#lap roi#salaried lap meaning#loan against property lap#fast loan against property#lap eligibility#apply for loan against property online#lap loan apply online#lap in loan#how to raise loan against property#lap loan full form#loan against property for salaried individuals#loan against residential property#lap loan documents required#loan against property fees and charges for salaried individuals#how to apply for loan against property for salaried individuals#loan against property for salaried individuals for home expenses#bank gives loan against property#lap loan legal associate#private loan against property#loan against immovable property#interest on lap#loan against property features for salaried individuals#loan against property mortgage#how to apply for loan against property for self employed individuals#loan against property features for self employed individuals#who can avail a loan against property

0 notes

Text

VVMC Property Tax: How to Pay in the Vasai-Virar Area?

Like other municipalities in the Mumbai Metropolitan Region (MMR), residents of Vasai-Virar must pay their property taxes on time. However, through the Vasai Virar City Municipal Corporation (VVMC) portal, homeowners can now pay their property taxes on time. This article lets us know the VVMC property tax payment process & download method in detail.

Table of Contents

Steps to Pay Property Tax Online

Factors Determining VVMC Property Tax

VVMC Property Tax: Payment Last Date

Penalties for Late Payment of VVMC Property Tax

Benefits of Online VVMC Property Tax Payment

Paying Taxes Offline

Helpline Contact Details

Vasai Virar City Municipal Corporation (VVMC) levies property tax on immovable properties under its jurisdiction. Every year, the civic body collects property taxes from the owners to maintain civic services.

The tax rate depends on the size and purpose of the property. Online payments can be made through the official portal hosted by VVMC for convenience. If you are new to paying VVC property tax online, read this article and explore the payment process, along with penalties and exemptions.

Steps to Pay Property Tax Online

Visit the official VVMC portal and click “Property Tax” under Civic Services.

Select “Online Payment”. You'll be redirected to online: Online Property Tax.

Search using your Property ID or owner’s name, plus ward and zone details

Review details—owner name, address, tax for 1 or 5 years, and any discounts.

Provide mobile number, email, captcha, etc., then click pay.

Choose your payment method (cards, net banking, UPI, wallets, EMI) and complete the transaction.

Download your receipt (show receipt history/download bill options are available).

Factors Determining VVMC Property Tax

It depends on the ward and zone of the property location.

The built-up area, or carpet area, of the property also determines the tax levied.

The type of property determines the tax. Residential properties face lower taxes in comparison to commercial properties.

The options available are Open Land, Residential, Hotel, Mixed, Non-Residential, Industrial and Hospital.

Construction Type: RCC, Paper Shed, or General Construction

Rent is sanctioned by VVMC for the same ward

The rateable value of the property is determined.

Formula

Rateable property = Standard rent x Area x 12 – Standard deduction of 10 percent

Tax Payment Last Date

The property tax payment deadline is December 31. Failure to comply with the correct payment dates may result in nominal penalties at the initial stage. Then facing legal consequences as discussed below.

Penalties for Late Payment of VVMC Property Tax

VVMC or VVCMC property tax is a monthly bill to be paid on time. However, if you consistently fail to pay the bill for more than three months, you will have to pay a penalty of two percent for every month of default.

Failure to pay property taxes from January to March will lead to an extra two percent being added to the overdue balance for each month after March. This penalty will continue to accrue until the complete bill, including any penalties, is paid off.

In addition, VVMC will also alert the authorities if Vasai Virar repeatedly defaults on property tax payments. As a result, legal action is taken in the worst cases.

Benefits of Online VVMC Property Tax Payment

The entire process is transparent to the property holder and the municipal corporation

You can find information on property tax, resolutions, amendments, and more on the official portal.

Online transactions can be easily completed by choosing from a variety of payment options.

Anyone with property details can pay taxes online to reduce hassle. There is no need to go to the municipal office and stand in the queue for tax payments. It has Online payments are a delight for property owners in the region.

Paying Taxes Offline

If you prefer the old-school method of paying your VVMC property taxes offline, you should visit the Vasai-Virar City Municipal Corporation Office (VVCMC Head Office) directly opposite Virar Police Station, Bazar Ward, Virar East, Maharashtra 401305.

Helpline Contact Details

Property owners can connect the contact details given below for any property tax-related queries.

Help Line Number: 8828137832

Email: [email protected]

Conclusion

Stay updated on the latest developments in the Indian real estate industry by following the Openplot.com Knowledge Center. Our platform provides informative articles, expert opinions, and market reports as well as valuable insights, news, and updates. Welcome to the world where your ideal home is just a click away!

0 notes

Text

How to Do Due Diligence and Related Laws in India

Introduction

In today’s complex legal and business environment, due diligence is more than a formal process — it’s a protective shield against financial, legal, and reputational risks. Whether you’re buying a business, investing in real estate, or entering into a joint venture, conducting proper due diligence is critical.

This blog outlines how due diligence should be carried out in India, the legal frameworks supporting it, and why it’s an indispensable step in any significant transaction.

What is Due Diligence?

Due diligence is a comprehensive investigation, audit, or review undertaken to verify facts before entering into an agreement or transaction. The goal is to identify red flags, validate claims, and ensure compliance with applicable laws and regulations.

In simple terms, it’s about “checking before trusting.”

Types of Due Diligence

Legal Due Diligence

Verification of ownership titles

Ongoing or past litigation

Intellectual property rights

Contractual obligations

2. Financial Due Diligence

Review of audited financial statements

Tax liabilities

Outstanding loans or dues

3. Operational Due Diligence

Business model and processes

Assets and infrastructure

Human resource obligations

4. Regulatory and Compliance Due Diligence

Licenses and permits

Environmental compliance

Adherence to industry-specific laws

5. Real Estate Due Diligence

Encumbrance certificates

Mutation and registry records

Zoning and land-use compliance

Step-by-Step Guide to Conducting Due Diligence in India

Step 1: Define Scope and Objectives

Identify what kind of due diligence is required — legal, financial, or technical — and the areas to focus on based on the nature of the transaction.

Step 2: Prepare a Due Diligence Checklist

Create a detailed checklist based on the type of transaction. For example:

Property: Title deeds, mutation records, property tax receipts

Business Acquisition: Company incorporation docs, contracts, licenses, past litigation

Step 3: Gather and Review Documents

Request necessary documents from the counterparty. Use non-disclosure agreements (NDAs) to ensure confidentiality.

Step 4: Conduct Site Visits and Interviews

If applicable, inspect properties, offices, or factories, and interview key personnel.

Step 5: Legal and Regulatory Check

Cross-check all documents with:

Government websites (RoC, land records, IPR registries)

Regulatory databases (SEBI, RBI, GST, PF/ESI)

Step 6: Identify Red Flags

Look for inconsistencies in documentation, hidden liabilities, unregistered agreements, or pending litigation.

Step 7: Prepare a Due Diligence Report

Summarize findings in a structured report highlighting:

Verified facts

Potential risks

Recommendations

Step 8: Take Legal Opinion

If any risk or doubt persists, seek a formal legal opinion before finalizing the transaction.

Key Indian Laws Relevant to Due Diligence

1. Companies Act, 2013

Verification of incorporation documents, directorship, shareholding, and financial filings

Check MCA (Ministry of Corporate Affairs) records

2. Income Tax Act, 1961

Ensure tax compliance, filing history, pending notices, and assessments

3. Transfer of Property Act, 1882

Governs sale and transfer of immovable property

4. Registration Act, 1908 & Indian Stamp Act, 1899

Ensure proper registration and stamping of property and commercial agreements

5. Real Estate (Regulation and Development) Act, 2016 (RERA)

Especially important in real estate projects to check builder registration, approvals, and legal status

6. Securities Laws (SEBI Regulations)

Applicable when dealing with listed entities or financial investments

7. Insolvency and Bankruptcy Code (IBC), 2016

Check if the company or asset is undergoing insolvency proceedings

8. Labour Laws

Due diligence on PF, ESI, Gratuity, and other employee obligations is crucial for mergers/acquisitions

Why Due Diligence Matters

Reduces Risk: Identify frauds, encumbrances, or liabilities

Ensures Compliance: Prevent future legal complications

Negotiation Tool: Helps in renegotiating terms based on findings

Builds Trust: Establishes a credible relationship between parties

Common Mistakes to Avoid

Relying solely on verbal representations

Ignoring local land laws or municipal rules

Overlooking third-party rights or encumbrances

Incomplete verification of licenses or permits

Conclusion

Whether you’re a startup founder, investor, legal professional, or property buyer — due diligence is not optional. It’s your first and best line of defense in ensuring you are entering a clean, risk-free, and legally compliant transaction.

In India, where regulatory landscapes are dynamic and documentation can be complex, expert-led due diligence can make all the difference. Don’t treat it as a formality — treat it as insurance for your investment.

About the Author

B S Makar, Advocate

Founder, B S Makar Advocates and Solicitors

📍Mohali, Punjab | 📞 +91–98781–31111

Specialist in Corporate Law, Civil Litigation, Real Estate, Insurance, and NRI Legal Matters

0 notes

Text

Loan Against Property – Residential, Commercial, and Industrial

Loan against property is popularly called LAP in the financial sector. As the name suggests, this is a type of loan that uses properties as security to extend a loan to individuals or corporates. This is the most simplified form of the loans available in the market. Loans Against Property (LAP) in India are secured loans where borrowers mortgage their residential, commercial, or industrial property to avail of funds from banks or financial institutions. It’s also one of the preferred tools on any business fundraising platform due to its collateral-backed nature.

Loan Against Property for corporates is a secured term loan where a company or promoter pledges owned immovable property—such as office buildings, warehouses, residential or industrial land—as collateral to raise funds for business purposes. This facility is widely used by small, medium, and large enterprises. Many corporates also use a fund raise platform in India to explore multiple lending options and get better deals.

Uses of Loan Against Property (LAP) by Corporates

Business expansion or diversification

Debt consolidation or refinancing high-cost loans

Equipment or infrastructure upgrades

Funding project execution or bridging capital gaps

Working capital requirements

Acquisition of other businesses or enhancing equity in the same business

Other customised requirements

Key Features of LAP in India

Loan Amount

₹5 lakhs to ₹500 crores, depending on security and financials (applies to residential, commercial, and industrial properties)

Loan-to-Value (LTV) Ratio

Residential: up to 90%

Commercial: up to 75%

Industrial: up to 80%

Interest Rate

Starts from 8.25% for all categories

Tenure

1 to 15 years

Loan Structure

Term Loan, Overdraft (OD), or Drop-line OD

Repayment Options

EMI or structured repayments based on cash flows

Loan Terms by Institution Type

Public & Private Sector Banks

Interest from 8.25% (typically the lowest)

Custom capping per sector/company

EMI-based repayment

Moratorium available

Small Finance Banks

Interest starts from 9%

Higher than major banks, lower than NBFCs

EMI-based repayment

Moratorium available

NBFCs

Interest starts from 10% (some from 9%)

Flexible repayment structures

Moratorium available

AIFs (Alternate Investment Funds)

Interest starts at 12%

Most flexible structure

Moratorium available

Benefits for Corporates

Access to large funds at competitive interest rates

Flexible fund usage compared to term loans

Structured repayments aligned with business cashflows

Monetisation of fixed assets without selling them

Longer loan terms

Easier to obtain than many unsecured options

Risks Involved

Risk of losing property if loan repayment defaults

Assessment Criteria for LAP

1. Property Valuation

Based on marketability, usage type (commercial/residential/industrial), and location

2. Company Financials

Includes DSCR, net worth, profitability, debt-to-equity ratio, GST payments, and repayment history

3. Director’s Financial Profile

Income sources, past repayment behavior, and background checks

4. Repayment Capacity

Evaluated through EBITDA, PAT, and promoter strength

5. Legal Due Diligence

Requires clear title, no litigation, and no encumbrances

Documents Required for LAP

A. Corporate Documents

Certificate of Incorporation / Partnership Deed / LLP Agreement

MOA & AOA / Board resolution for borrowing

GST, PAN, and company KYC

CA-certified list of directors and shareholders

Director KYC (Aadhaar, PAN)

Business licenses and compliance documents

Udyam and MSME registration (if applicable)

Plant ownership and production capacity details

External credit rating (for loans above ₹25 Cr)

Civil case records

ESG compliance certificates

B. Financial Documents

3 years of audited financials (all group companies)

CA-certified provisional financials (current year)

Financial projections

GST returns

Bank statements (company + promoters, 12 months)

Net worth certificates

ITR, 26AS, computation (group + promoters)

Debt profile and sanction letters

Tax audit reports

Interest cost breakdown

List of creditors and debtors

Past and planned capex

C. Property Documents

Title deed and ownership proof

Ownership chain

Property tax receipts

Building approvals

No encumbrance certificate

Valuation certificate

Area chart

Process Flow to Raise LAP

Identify suitable lenders (based on amount, LTV, tenure, rate)

Submit application in lender’s format

Submit required documents

Property valuation and legal check (borrower pays fees)

Loan sanction and term sheet approval

Execute loan agreement

Disbursement

Many companies use self-promotion for funding through investor communications or funding announcements platforms to highlight capital-raising efforts and boost visibility.

Top Lenders for LAP in India

Banks: HDFC, ICICI, Axis Bank, SBI

NBFCs: Tata Capital, Aditya Birla, Piramal, Bajaj Finance

HFCs: LIC Housing Finance, ICICI Housing Finance

How to Raise LAP for Your Business

Though LAP seems simple, it involves strategic lender selection, negotiation, documentation, and follow-up. Even a small savings (e.g., 0.1% interest) can save you substantial money.

If you're seeking support, we offer advisory services with a strong lender and investor network and experience in raising business loans and funding across sectors. Whether you apply directly or through a business finance news portal, expert guidance makes the difference.

Our USP: Transparency, no false promises, professionalism, and reasonable fees You Get: Capital in the shortest possible time Also Promote: Submit fund raise updates and share your growth story on trusted platforms.

0 notes

Text

Top 7 Benefits of Taking a Loan Against Property in India

Introduction

Loan Against Property (LAP) has gained popularity in India as an effective financing option for those who own immovable property. Its structured benefits make it superior to many other loan types.

1. High Loan Amount Eligibility

Because the loan is secured by a tangible asset, lenders are comfortable offering a higher loan amount, often up to 75% of the market value of the property.

2. Lower Interest Rates

Interest rates on LAP are significantly lower than unsecured loans like personal loans, making it a cost-effective option. The collateral reduces the lender’s risk.

3. Longer Repayment Tenure

Repayment periods can extend up to 20 years, easing the burden of monthly EMIs and improving affordability for the borrower.

4. Multi-Purpose Usage

Funds from a LAP can be used for:

Business expansion

Funding a child’s higher education

Marriage expenses

Medical emergencies

Debt consolidation

5. Ownership Retention

Unlike selling the property to raise money, a LAP allows you to retain ownership while still benefiting from its value.

6. Better than Selling Property

Real estate is a long-term appreciating asset. A loan against it provides liquidity while preserving the investment benefits of property ownership.

7. Possible Tax Benefits

While LAP doesn’t offer standard tax benefits like home loans, if used for business purposes, interest payments may be claimed as a business expense.

0 notes

Text

Understanding Movable Property: A Comprehensive Guide

When it comes to assets and ownership, property can be broadly classified into two main types: movable property and immovable property. Understanding the distinction between these two categories is crucial for anyone dealing with real estate, legal matters, or personal investments. In this article, we will delve deep into what movable property entails, how it differs from immovable property, and explore the increasingly popular concept of the portable house.

What Is Movable Property?

Movable property refers to assets that can be physically relocated from one place to another without altering their nature or value. This type of property is also known as personal property or chattel. Examples include vehicles, furniture, jewelry, electronics, and even livestock. Essentially, if you can transport it without causing damage to the item or the land, it falls under the category of movable property.

Movable property is typically easier to transfer, sell, or lease compared to immovable property. Legal transactions involving movable property usually require less paperwork and fewer regulatory hurdles. This flexibility makes movable property a significant aspect of both personal and business asset portfolios.

The Legal Perspective

From a legal standpoint, movable property is governed by different laws than immovable property. For example, in many jurisdictions, the sale of movable property is regulated under the Sale of Goods Act or its equivalent. These laws stipulate the terms and conditions for the transfer of ownership, warranties, and liabilities.

Another key point is that movable property is generally not subject to the same kind of taxes and duties as immovable property. This makes it an attractive option for investors who are looking to diversify their assets without getting entangled in complex legal obligations.

Immovable Property: A Quick Overview

In contrast to movable property, immovable property consists of assets that are permanently attached to the earth. This includes land, buildings, and anything that is permanently affixed to the land, such as trees and machinery embedded in the ground. Immovable property is often the focus of real estate transactions and typically involves a more complicated legal process, including registration, stamp duties, and often, higher taxes.

Immovable property is considered a stable and long-term investment. However, its lack of liquidity can be a disadvantage for those who may need quick access to capital. Unlike movable property, you cannot simply pick up a piece of real estate and relocate it, making it a more permanent asset.

The Rise of the Portable House

One fascinating development that blurs the lines between movable property and immovable property is the portable house. A portable house, also known as a mobile home or modular home, is designed to be easily transportable while offering the comforts and amenities of a permanent residence. These homes have gained popularity due to their flexibility, cost-effectiveness, and adaptability to various lifestyles.

Portable houses come in various designs, from tiny homes on wheels to more elaborate modular structures that can be disassembled and reassembled at different locations. They are an ideal solution for people who seek mobility without sacrificing the stability of a home environment.

In many legal systems, a portable house is classified as movable property until it is permanently affixed to land. Once installed and connected to utilities like water, electricity, and sewage, it may be reclassified as immovable property. This dual nature makes the portable house a unique and versatile option in the property market.

Why the Distinction Matters

Understanding whether a property is movable or immovable has significant implications for ownership rights, taxation, inheritance, and legal disputes. For instance, in the case of inheritance, movable property is usually easier to distribute among heirs, while immovable property might require a formal division of land or sale to distribute its value.

In business contexts, companies often need to account for movable and immovable property separately in their financial statements. This distinction can affect everything from asset depreciation to insurance coverage.

Investment Considerations

Both movable property and immovable property have their own set of advantages and risks. Movable property offers liquidity and ease of transfer but may depreciate quickly, especially in the case of vehicles or electronics. Immovable property, on the other hand, often appreciates over time and can generate steady rental income but requires significant upfront investment and ongoing maintenance.

The emergence of the portable house offers a middle ground, providing both mobility and the potential for long-term residence. As housing markets become increasingly competitive and lifestyles more dynamic, the portable house is likely to play a growing role in future housing solutions.

Final Thought

Movable property is a broad category that encompasses everything from your car to your jewelry, and even to innovative housing solutions like the portable house. While immovable property remains a cornerstone of long-term investment strategies, the flexibility and ease associated with movable property cannot be overlooked. Whether you are an investor, a homeowner, or someone simply curious about your assets, understanding these distinctions is key to making informed decisions.

In today’s fast-paced world, where the lines between movable property and immovable property are increasingly blurred by innovations like the portable house, staying informed is more important than ever. Whether you are buying your first car, investing in real estate, or considering a move into a portable house, knowing the legal and practical aspects of movable property will serve you well.

0 notes

Text

Understanding Tax on Property Sale in India: A Comprehensive Guide

Tax on property sale in India can be a lucrative endeavor, but it also comes with tax implications that every seller must understand. The taxation on property sale primarily revolves around Capital Gains Tax, which is categorized into Short-Term Capital Gains (STCG) and Long-Term Capital Gains (LTCG). The tax treatment varies based on the holding period of the property and the applicable provisions under the Income Tax Act.

1. Classification of Capital Assets

Under the Income Tax Act, a capital asset is defined as property of any kind held by an individual, whether connected with business or profession. However, certain assets like stock-in-trade, personal effects, and agricultural land in rural areas are excluded from this definition.

The classification of capital assets into short-term and long-term depends on the holding period:

Short-Term Capital Asset (STCA): If the property is sold within 24 months of acquisition.

Long-Term Capital Asset (LTCA): If the property is sold after 24 months of acquisition.

This classification is crucial as it determines the tax rate applicable on the capital gains.

2. Tax Rates on Capital Gains

The tax rates on capital gains differ based on the holding period and the nature of the asset: Type of GainHolding PeriodTax Rate (FY 2024-25)NotesShort-Term Capital GainUp to 24 monthsAs per income tax slabTaxed as per the individual's applicable income tax slab rate.Long-Term Capital GainAbove 24 months12.5% (without indexation)The indexation benefit has been discontinued.

Note: The above rates are applicable to immovable property, such as land and buildings.

3. Calculation of Capital Gains

The calculation of capital gains involves determining the difference between the sale consideration and the cost of acquisition and cost of improvement. The formula is:

Capital Gain = Sale Consideration – (Cost of Acquisition + Cost of Improvement + Transfer Expenses)

Sale Consideration: The amount received from the sale of the property.

Cost of Acquisition: The original purchase price of the property.

Cost of Improvement: The expenses incurred to enhance the value of the property.

Transfer Expenses: Expenses directly related to the sale, such as brokerage fees and legal charges.

For Short-Term Capital Gains, the resulting gain is added to the total income and taxed as per the applicable income tax slab.

For Long-Term Capital Gains, the gain is taxed at 12.5% without the benefit of indexation.

4. Exemptions Available

The Income Tax Act provides certain exemptions to reduce the tax liability on capital gains:

a. Section 54 – Reinvestment in Residential Property

Under Section 54, an individual can claim an exemption on LTCG arising from the sale of a residential property if the following conditions are met:

The gain is reinvested in purchasing a new residential property within 1 year before or 2 years after the date of transfer.

Alternatively, the gain can be used to construct a new residential property within 3 years from the date of transfer.

The exemption is available only for one residential property and is subject to certain conditions and limits.

b. Section 54F – Reinvestment in Residential Property

Section 54F provides an exemption on LTCG arising from the sale of any long-term capital asset other than a residential house, provided:

The entire sale proceeds are invested in purchasing a new residential property.

The new property must be purchased within 1 year before or 2 years after the date of transfer, or constructed within 3 years from the date of transfer.

If the entire sale proceeds are not reinvested, the exemption is proportionately reduced.

c. Section 54EC – Investment in Specified Bonds

Under Section 54EC, an individual can claim an exemption on LTCG arising from the sale of property if the gain is reinvested in specified bonds, such as those issued by the National Highways Authority of India (NHAI) or Rural Electrification Corporation (REC), within 6 months from the date of transfer. The maximum exemption limit is ₹50 lakh.

The investment in these bonds must be held for a minimum period of 5 years.

5. Tax Deducted at Source (TDS)

When selling a property, the buyer is required to deduct 1% TDS under Section 194-IA if the sale consideration exceeds ₹50 lakh. The TDS is deducted at the time of payment or credit, whichever is earlier, and is remitted to the government.

For non-resident sellers, the TDS rate is 20% for LTCG and as per the applicable income tax slab for STCG.

6. Recent Amendments and Relaxations

In response to public feedback, the Indian government has introduced certain relaxations in the capital gains tax regime:

Option to Choose Tax Rate: Taxpayers have the option to choose between the new 12.5% tax rate without indexation or the previous 20% tax rate with indexation for the sale of property made on or after 23rd July 2024.

Indexation Benefit: The indexation benefit, which adjusts the cost of acquisition for inflation, has been discontinued. However, taxpayers can choose to continue with the previous indexation benefit if they opt for the 20% tax rate.

These changes aim to provide flexibility and alleviate the tax burden on property sellers.

7. Strategic Tax Planning

To minimize tax liability on the sale of property, consider the following strategies:

Reinvest in Residential Property: Utilize Sections 54 and 54F to claim exemptions by reinvesting the capital gains in purchasing or constructing a new residential property.

Invest in Specified Bonds: Under Section 54EC, invest the capital gains in specified bonds to claim exemptions.

Utilize Capital Gains Account Scheme (CGAS): If reinvestment is not immediate, deposit the capital gains in a CGAS to claim temporary exemptions.

Offset Capital Losses: If you have incurred capital losses from other investments, offset them against the capital gains to reduce the taxable amount.

Understanding the Tax on property sale is crucial for effective financial planning. By classifying the capital gains correctly, utilizing available exemptions, and engaging in strategic tax planning, property sellers can minimize their tax liabilities and maximize their returns.

1 note

·

View note

Text

How to Make a Special Power of Attorney

A Special Power of Attorney (SPA) is a legal document that grants specific and limited authority to another person, known as the agent or attorney-in-fact, to perform certain acts on behalf of the principal (the person creating the SPA). This type of power of attorney is useful for delegating authority for a single transaction or limited duty, such as selling property, collecting rent, managing a bank account, or signing documents in the principal’s absence.

Creating a legally valid SPA involves a few essential steps to ensure clarity, legality, and protection of all parties involved.

Step 1: Identify the Purpose

Before drafting the SPA, clearly determine the specific task or transaction for which the authority is being granted. Since an SPA is limited in scope, it should not cover broad or general responsibilities. Be precise—mention the property involved, the bank account, or the type of document the agent will handle.

Step 2: Choose the Right Agent

Select a trustworthy and responsible person as your agent. The agent should have the capability and willingness to act in your best interests. Since the authority granted is specific, choose someone familiar with the task or someone you can guide easily.

Step 3: Draft the Document

The SPA document must include key elements such as:

Full name and address of the principal

Full name and address of the agent

A clear, detailed description of the powers being granted

The effective date and the duration or expiration of the SPAA statement declaring that the agent’s authority is limited to the stated tasks

Step 4: Sign the Document in the Presence of Witnesses

To validate the SPA, it must be signed by the principal in the presence of at least two witnesses who are not related to the agent or principal. Witnesses must also sign the document.

Step 5: Notarization and Registration (if required)

In many jurisdictions, especially in cases involving real estate, it is important to notarize the SPA to verify its authenticity. If the SPA pertains to immovable property, it may also need to be registered at the local sub-registrar’s office to be legally enforceable.

Step 6: Deliver Copies

Provide a signed copy of the SPA to the agent and, if applicable, to the relevant authorities such as banks, legal representatives, or government offices involved in the transaction.In conclusion, making a Special Power of Attorney is a straightforward but legally sensitive process. It offers a safe way to delegate authority for a specific task, ensuring convenience without compromising control. Consulting a lawyer is recommended to ensure the document is correctly drafted and complies with local laws.

For More Information, Visit Us - https://safeledger.ae/how-to-make-a-special-power-of-attorney/

0 notes

Text

Why is real estate the safest long-term investment?

Real estate is the term used to describe a property or properties that are made up of land and one or more structures. In addition to any immovable property of this type, the real estate also includes natural resources like water, agriculture, and minerals. These might be residences or structures in general.

Describe an investment

Allocating funds with the hope of receiving returns or other advantages in the future is known as investing. The key question of "what is an investment?" is financial gain or loss, unrealised capital appreciation or depreciation, and investment earnings like dividends, interest, and rental income. These will also include income and a capital gain. Those who make investments are known as investors, and they typically anticipate greater returns on riskier ventures.

Experts in the field use a certain investment technique that helps diversify their portfolio. Stocks and shares, fixed interests, gold, and real estate are the four primary investment vehicles. Among these, real estate is quickly becoming as the greatest and safest investment option available today.

Why make a real estate investment?

According to the 2016 Gallop Poll, real estate is the greatest and safest long-term investment, far outperforming alternatives like stocks, mutual funds, and gold, to mention a few. The unexpected truth about real estate is that, despite market swings, owning a home or property provides both reliable returns and emotional fulfilment. Forecasting findings indicate that the real estate industry is currently in a recovery phase, despite having reached a very low point in the past.

On a worldwide scale, real estate investing is also the safest choice. Compared to stocks and shares, real estate investing carries no risk. As previously said, real estate offers consistent, high profits over an extended period of time. An excellent example would be a consistent rental income. By paying a portion up front and the remaining amount over time in installments, real estate owners can use leverage to buy properties.

Methods for Real Estate Investment

Become a landlord

Using well-known platforms like Airbnb to rent out a portion of your house might be a wise real estate investment. In this sense, renting a home or owned building via any other reliable and secure method is also a smart move. You can make significant money even by renting out a room.

Invest in rental homes

The real estate sector is experiencing a rise in house-hacking. In a multi-unit building, the landlord either rents out the units or lives in one area of the home and rents the others. This can generate income with little difficulty.

Make use of a real estate website

Online real estate platforms are a good way for real estate investors to interact with developers. For their investments in the developers' numerous initiatives, investors receive payouts on a monthly and quarterly basis.

Turn over investment properties

You purchase a home at a discount, do good renovations, and then sell it for a profit. This is the main idea behind flip-house investing.

Real estate investment trusts, or REITs, make real estate investments without physically inspecting the property. They resemble mutual funds. Investing in companies that manage commercial real estate holdings will yield substantial returns.

Concluding

According to these data, real estate is among the safest and most lucrative investment possibilities available.

#real estate the safest long-term investment#the safest long-term investment#long-term investment#Real estate

0 notes

Text

How NRIs Can Use Power of Attorney (POA) to Sell Property in India

Selling property in India as a Non-Resident Indian (NRI) can be a complex process, especially when personal presence isn't feasible. In such scenarios, granting a Power of Attorney (POA) becomes a practical solution. This article delves into how NRIs can effectively utilize a POA to sell property in India, ensuring compliance with legal requirements and smooth transaction execution.

Understanding Power of Attorney (POA)

A Power of Attorney is a legal document that allows an individual to appoint another person (the agent or attorney-in-fact) to act on their behalf in legal or financial matters. For NRIs selling property in India, a POA is particularly useful in managing or transferring ownership without the need for physical presence.

Types of POA Relevant to NRIs

General Power of Attorney (GPA): Grants broad powers to the agent to act on behalf of the principal in various matters, including property transactions.

Special Power of Attorney (SPA): Limits the agent's authority to specific acts, such as selling a particular property.

Most NRIs selling property in India opt for a SPA when authorizing someone to handle the transaction, as it clearly defines the scope of the agent’s powers, minimizing potential misuse.

Executing a POA: Step-by-Step Guide

Drafting the POA: The NRI POA to sell property in India should be meticulously drafted, detailing the powers granted to the agent, the specific property in question, and any limitations.

Notarization: The drafted POA must be notarized in the country of the NRI's residence. This involves signing the document in the presence of a notary public.

Attestation: Post-notarization, the POA should be attested by the Indian Embassy or Consulate in the NRI's country of residence. This step authenticates the document for use in India.

Adjudication in India: Upon reaching India, the POA must be stamped and adjudicated as per the Indian Stamp Act within a specified period, usually 3 months.

Legal Framework and Compliance

The execution of an NRI POA to sell property in India is governed by specific regulations to prevent fraud and ensure authenticity. According to legal experts, "In case the buyer is an NRI, the POA needs to be certified by the Indian Consulate/Embassy of the country in which he/she resides."

Drafting an Agreement to Sell

Once the POA is in place, the appointed agent can proceed with the NRI agreement to sell a property. The initial step involves drafting an Agreement to Sell, a document that outlines the terms and conditions of the sale between the NRI seller and the buyer. This agreement typically includes:

Property Description: Detailed information about the property being sold.

Sale Price and Payment Terms: Agreed-upon price and the schedule of payments.

Final Registry Deadline: Timeline for completing the sale deed and property registration.

Dispute Resolution Process: Mechanisms for resolving any disagreements arising from the transaction.

It is common for the buyer to pay an initial deposit, often around 10-20% of the property's value, upon signing the NRI agreement to sell a property.

Tax Implications and Repatriation

NRIs selling property in India must be aware of the tax liabilities arising from property sales:

Capital Gains Tax: Depending on the duration of property ownership, short-term or long-term capital gains tax may apply.

Tax Deducted at Source (TDS): Buyers are required to deduct TDS at applicable rates before making payment to the NRI seller.

Repatriating the sale proceeds involves adhering to foreign exchange regulations. As per Indian banking guidelines, "As an NRI, you may inherit any immovable property and you can repatriate the sale proceeds up to USD 1 million per financial year."

Role of Professional Assistance

Navigating the legal and procedural intricacies of NRI selling property in India can be challenging. Engaging professionals, such as legal advisors and real estate consultants, can facilitate compliance and streamline the process.

India for NRI: Your Trusted Partner

For NRIs seeking assistance in NRI POA to sell property in India, India for NRI offers comprehensive services, including:

Legal Advisory: Expert guidance on property laws and regulations.

POA Execution: Assistance in drafting, notarizing, and attesting POA documents.

Taxation Support: Advisory on tax implications and repatriation procedures.

Leveraging such services ensures that NRIs selling property in India can manage their transactions effectively and in compliance with all legal requirements.

Conclusion

Utilizing a Power of Attorney (POA) is a practical solution for NRIs aiming to sell property in India without being physically present. By following the proper procedures for executing an NRI POA to sell property in India, drafting a clear NRI agreement to sell property, and understanding the associated tax implications, NRIs can ensure a smooth and legally compliant transaction.

0 notes

Text

What is Immovable Property? Definition, Differences, and Examples

Property ownership is a fundamental aspect of human civilization, and understanding the different types of property is crucial in legal, financial, and investment contexts. Among the classifications of property, immovable property plays a significant role, especially in real estate, taxation, and inheritance matters. But what is immovable property, and how does it differ from movable property? In this blog, we will explore the concept, understand the difference between movable and immovable property, and delve into examples of immovable property that can help clarify this important topic.

What is Immovable Property?

In simple terms, immovable property refers to any property that cannot be moved from one place to another without altering its nature or damaging its structure. According to various legal systems, immovable property typically includes land and things permanently attached to the land. This can include buildings, trees, and structures like bridges and wells.

Legal Definition of Immovable Property

The legal interpretation of what is immovable property can vary depending on the jurisdiction. However, a commonly accepted definition is provided under the Transfer of Property Act, 1882 (India), which states:

“Immovable property does not include standing timber, growing crops, or grass, but it includes land, benefits to arise out of land, and things attached to the earth.”

In essence, immovable property includes not just the land itself but also any permanent structures or benefits arising from the land, such as mineral rights or lease rights.

Difference Between Movable and Immovable Property

To better understand what is immovable property, it's helpful to compare it with its counterpart—movable property. The difference between movable and immovable property is a critical distinction in property law and plays a vital role in taxation, registration, and ownership transfer.

1. Mobility

Movable Property: As the name suggests, movable property can be physically moved from one location to another without damaging its structure or nature. Examples include vehicles, furniture, jewelry, and electronics.

Immovable Property: Cannot be moved without causing damage or altering its essence. Land, buildings, and trees rooted in the ground are examples of immovable property.

2. Transfer Process

Movable Property: The transfer of movable property typically does not require registration and is relatively easier. A simple sale agreement or delivery can suffice.

Immovable Property: Transfer of immovable property requires registration, stamp duty, and adherence to legal procedures to ensure a legitimate and binding transaction.

3. Tax Implications

Movable Property: Taxes like sales tax or goods and services tax (GST) may apply.

Immovable Property: Attracts property tax, stamp duty, capital gains tax, and registration fees.

4. Documentation

Movable Property: Ownership is usually proven through purchase receipts, bills of sale, or possession.

Immovable Property: Ownership must be proved through title deeds, property registration, and encumbrance certificates.